Idaho’s Teton County Commissioner Ron James, who owns Captain Ron’s Smokehouse in Driggs, cleared the first legislative hurdle Monday in his push to allow Idaho counties to tax short-term rentals to cover tourist impacts.

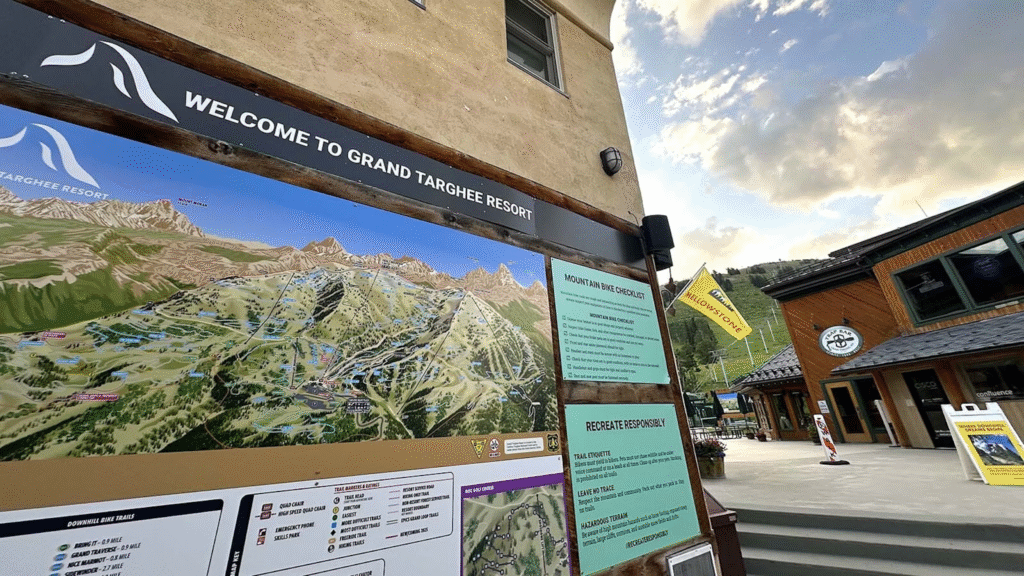

James successfully presented proposed legislation to the Idaho Association of Counties Revenue and Taxation Committee in Boise, advancing a measure that could assist his cash-strapped county in dealing with thousands of visitors to the Grand Targhee Resort in Alta, Wyoming.

Idaho’s limited revenue options create what James refers to as a “double whammy,” in which his county provides law enforcement, emergency services, and road maintenance to tourists but cannot collect significant tax revenue from their visits.

“At any given time, there might only be one or two deputies patrolling the whole county,” James told Cowboy State Daily.

This is one example of the resource strain that occurs when James’ county absorbs the impact of tourism while feeling left out, despite neighboring Wyoming counties collecting ample lodging tax revenue.

Haves vs. Have Nots?

The proposed $1.5 billion Grand Targhee Resort expansion illustrates the dramatic funding disparity between the two states. James said the project will generate about $2.8 million annually for Teton County, Wyoming, and perhaps as much as $1.8 million for Idaho Falls.

Idaho cities can use local taxes to fund tourism, but counties cannot.

At the same time, Idaho counties face a 3% annual cap on property tax increases.

According to James, this results in them falling behind inflation, whereas Wyoming’s more flexible tax structure generates significant tourism revenue.

Teton County, Idaho, said James will receive approximately $287,000 in tax revenue from the Grand Targhee expansion, while bearing the brunt of the expected tourism impact.

“The only way to get to that ski resort is through our county,” James said. “And the majority of the people that are going to be going to ski, they’re going to be staying in our VRBOs and our hotels.”

Commissioner Dan Powers, who works alongside James, explained that Idaho’s tax structure puts counties at a significant disadvantage compared to Wyoming.

“We just fall a little further behind every year because it’s not even covering inflation,” says Powers.

Some Support

Wyoming’s Teton County already provides financial assistance to Idaho for services that benefit its residents. According to Powers, “they contribute to fire and EMS, right now.”

Commissioner Wes Gardner of Wyoming’s Teton County acknowledged his neighbors’ challenges following a joint meeting of the two county commissions on September 9.

“Their residents are our workforce,” Gardner stated. “When you compare funding for a county in Idaho to running a county in Wyoming, the funding available differs. So that complicates things.

Gardner stated that Idaho commissioners were “experiencing significant impacts from properties in Wyoming on their infrastructure, whether that is roads, deputies, or ambulances.” And they’re asking for assistance.”

The proposed legislation would allow Idaho counties to levy up to a 2% “user fee” on short-term rentals to help “mitigate the cost of the impact that they bring when they come and visit our towns,” James explained.

The legislation now requires approval from the entire Idaho Association of Counties, which only sends five resolutions to the state legislature each session. If chosen, it would go through the legislative process when Idaho’s Legislature convenes in January for its 100-day session.

Before that, James stated that he and other Idaho county commissioners are forming a coalition to seek additional revenue sources.

He went on: “There’s more counties in favor of doing this because they’re feeling the same effects we are.”